How much will mortgage lenders lend me

For Tuesday September 13 2022 here are the current mortgage rates in Michigan. Ad Top-Rated Mortgage Companies 2022.

Usda Home Loans Home Loans First Time Home Buyers Usda Loan

We are 1 out of 3 Diamond Certified home lenders in the Bay Area offering residential mortgage loans and refinancing.

. LVR is calculated by comparing how much is being borrowed against the total value of the property. Typically the higher your deposit the lower your LTV. VA Home Loans are provided by private lenders such as banks and mortgage companies.

Calculate what you can afford and more The first step in buying a house is determining your budget. Common mortgage terms are 30-year or 15-year. Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

So in simplistic terms if the property is worth 500000 and you. This mortgage calculator will show how much you can afford. These monthly expenses include property taxes PMI association.

Find A Great Lender For Your Needs And Get One Step Closer To Moving Into Your Next Home. A 15-year fixed-rate mortgage of 100000 with. Ad Top Home Loans.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less. DTI Often Determines How Much a Lender Will Lend So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses.

Take Advantage And Lock In A Great Rate. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend. Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow.

Number of payments over the loans lifetime Multiply the number of years in your loan term by 12 the number of months in a year to get the number of payments for your loan. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. If your loan is a federally related mortgage loan under RESPA then there are limits on how much a lender can make you pay both at closing and in your recurring mortgage payments.

California mortgage rates today are 3 basis points lower than the national average rate. The APR on a 15-year fixed is 537. Ad Lender Mortgage Rates Have Been At Historic Lows.

Todays rate is higher than the 52-week low of 462. Find financial calculators mortgage rates mortgage lenders insurance quotes refinance information home equity loans credit reports and home finance advice. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

The current average 30-year fixed mortgage rate in California remained stable at 523. VA guarantees a portion of the loan enabling the lender to provide you with more. This mortgage calculator will show how much you can afford.

The average 30-year fixed mortgage rate is. You may qualify for a loan amount of 252720 and your total monthly mortgage. Longer terms usually have higher rates but lower.

Give us a call today for a complimentary consultation. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your. Mortgages are how most people are able to.

2 hours agoWhat Are Todays Mortgage Rates in Michigan. It was 533 this time last week. For this reason our calculator uses your.

Get Low Home Loan Rates 10 Best Mortgage Lenders Compare Companies Top Online Deals. Lets start with LVR. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month.

Typically lenders cap the mortgage at 28 percent of your monthly income. A mortgage loan term is the maximum length of time you have to repay the loan. So if you earn 30000 per year and the lender will lend four times.

Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. Fill in the entry fields.

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

Usda Loan Pros And Cons Usda Loan Understanding Mortgages Mortgage

5 Things Not To Do During The Mortgage Process It Doesn T Mean You Definitely Won T Get Approved For The Loan But Informative Mortgage Process How To Apply

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

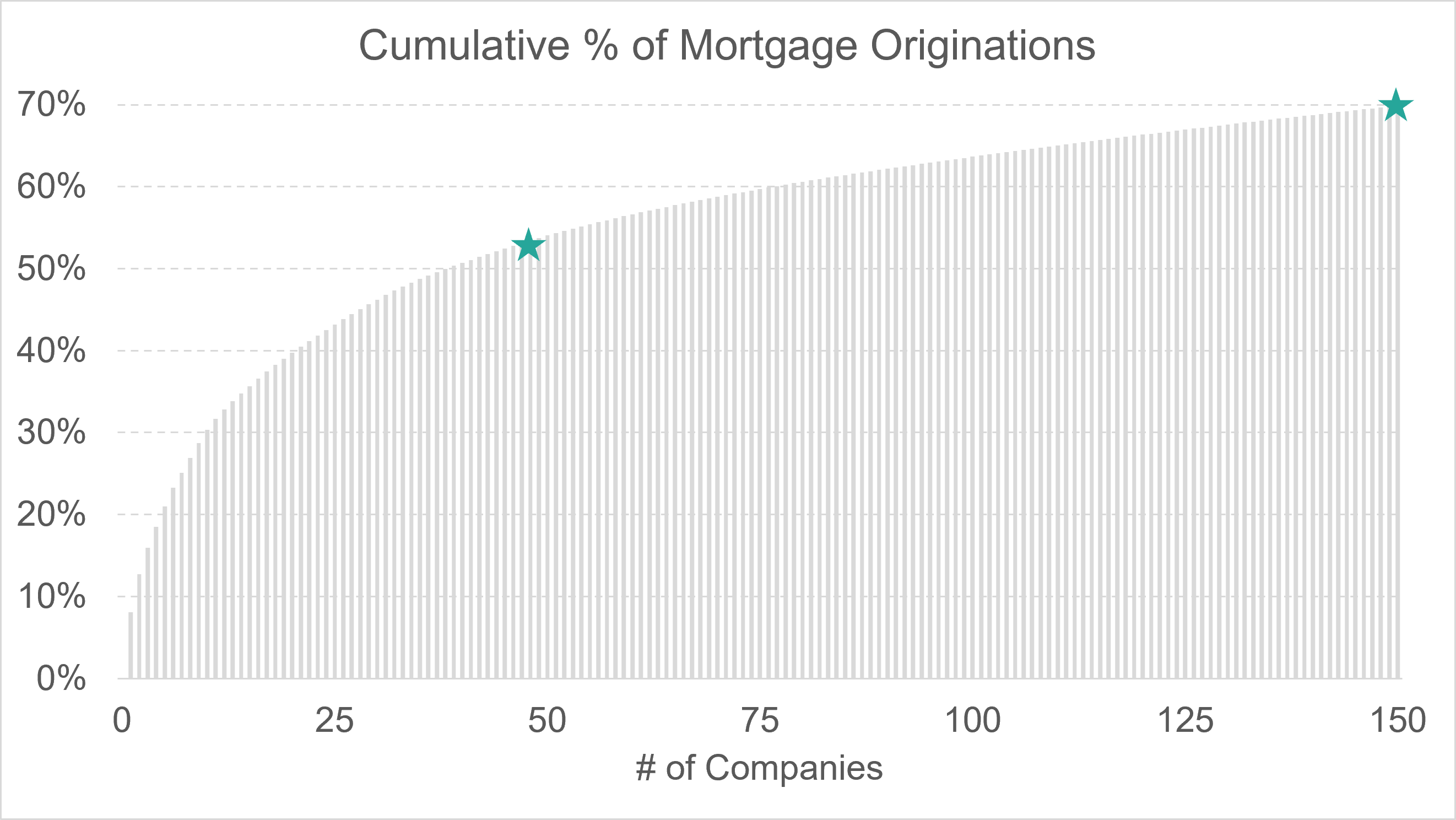

The Top 150 Mortgage Lenders In 2020 Bundle

The Keys To Home Affordability How Much You Can Borrow The Borrowers Real Estate News I Can

How To Choose A Mortgage Lender Money

Largest Mortgage Lenders U S 2021 Statista

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

Australia Largest Mortgage Lenders 2021 Statista

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You

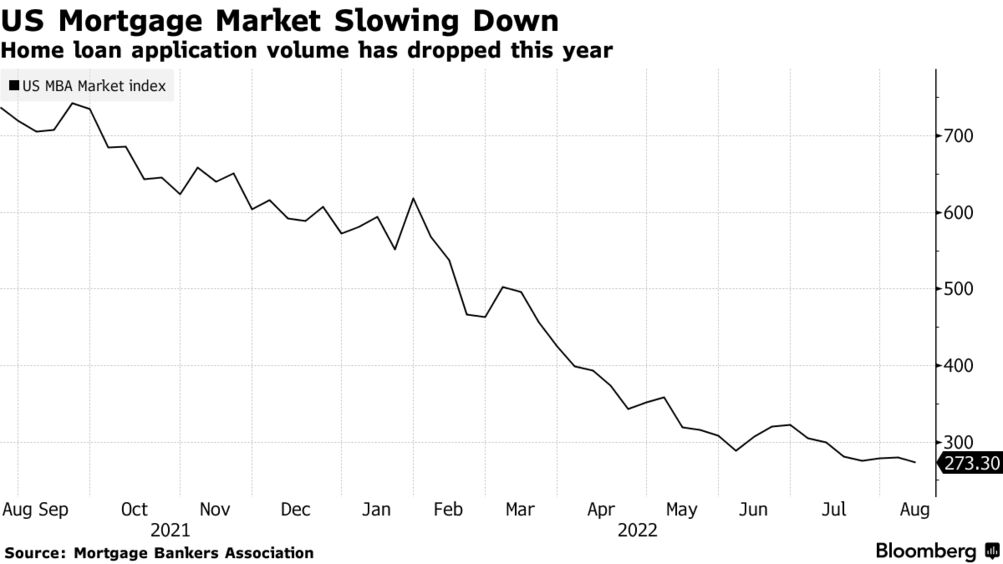

Us Mortgage Lenders Are Starting To Go Broke As Loan Volumes Plunge Bloomberg

What Is A Loan Estimate How To Read And What To Look For

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

Best Online Mortgage Lenders Of 2020 Money S Top Picks

The Best Mortgage Lenders Of September 2022